The Brazilian stock market, Ibovespa, ended July 25, 2025, down 0.21%, closing at 133,524.18 points, impacted by domestic inflation, unresolved U.S. trade talks, and broader economic pressures.

The day began cautiously with investors absorbing a higher-than-expected IPCA-15 inflation figure, at 0.33% for July, signaling persistent price pressures despite ongoing high interest rates.

Macroeconomic worries intensified as the IPCA-15 inflation index revealed a blockulative 12-month rise of 5.30%, exceeding central bank targets.

Investors anticipate the Brazilian central bank will maintain the Selic interest rate at 15%, reflecting caution against lingering inflationary pressures.

Further economic data heightened concerns as Brazil’s current account deficit sharply widened to $5.13 billion in June, surp***ing the forecasted deficit of $4.36 billion.

This significant increase from May’s deficit of $2.93 billion highlights worsening trade and investment imbalances, driven by greater imports than exports.

At the same time, foreign direct investment (FDI) into Brazil notably declined to $2.81 billion in June, falling short of the projected $4.50 billion.

This drop from May’s figure of $3.66 billion reflects decreased investor confidence, fueled by uncertainties about Brazil’s economic outlook and global market conditions.

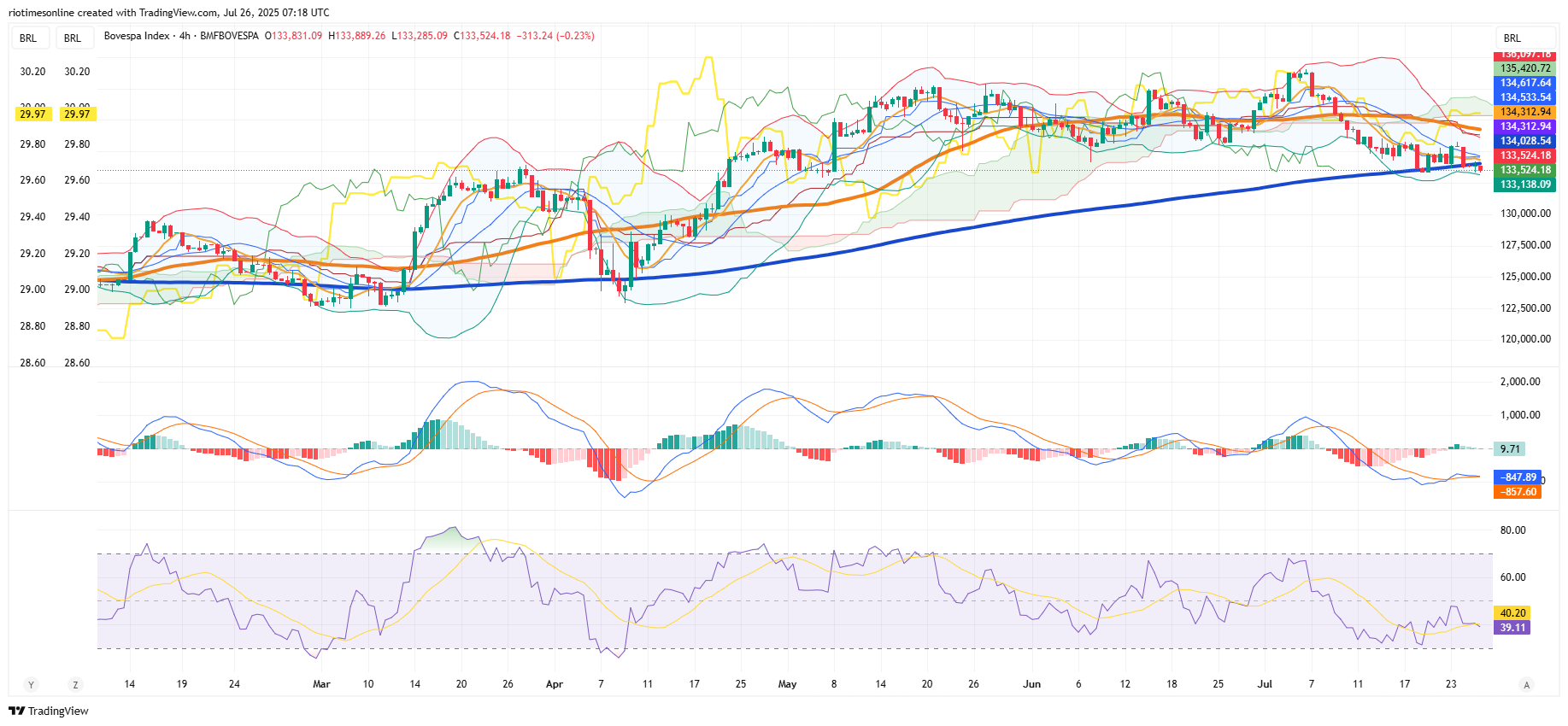

Technical ***ysis further indicates downward pressure, confirmed by the Ibovespa’s decline below its critical 200-day moving average on the 4-hour chart after eight attempts.

This breach signals potential ongoing downward momentum, alarming traders who view this as a bearish indicator.

Brazilian Stock Market Retreats Amid Inflation, Trade Disputes, and Economic Strains

Further supporting negative sentiment, technical indicators such as the MACD showed growing downside momentum, with the MACD line positioned below the signal line.

The Relative Strength Index (RSI) hovered around the 40 mark, indicating moderate oversold conditions without clear signs of immediate recovery.

Dexco’s stock stood out positively, rising 4.14% after receiving favorable ***yst coverage with a target price of R$8.50, highlighting strong market fundamentals.

Conversely, Yduqs led declines, dropping 4.77% following unexpected executive leadership changes, reflecting investor unease regarding corporate governance transitions.

Meanwhile, U.S. markets displayed resilience, with the Dow Jones rising 0.47%, the S&P 500 increasing 0.40%, and the Nasdaq edging up 0.24%, all achieving record closes.

Investor confidence in the U.S. was buoyed by promising corporate earnings and optimism about European trade relations.

Overall, Brazil’s market faces continued challenges from internal economic vulnerabilities, inflationary pressures, declining foreign investment, and external trade disputes.

Businesses and investors remain cautious, closely monitoring policy decisions, inflation developments, and trade negotiations, indicating potential volatility ahead.

Source link

https://findsuperdeals.shop/